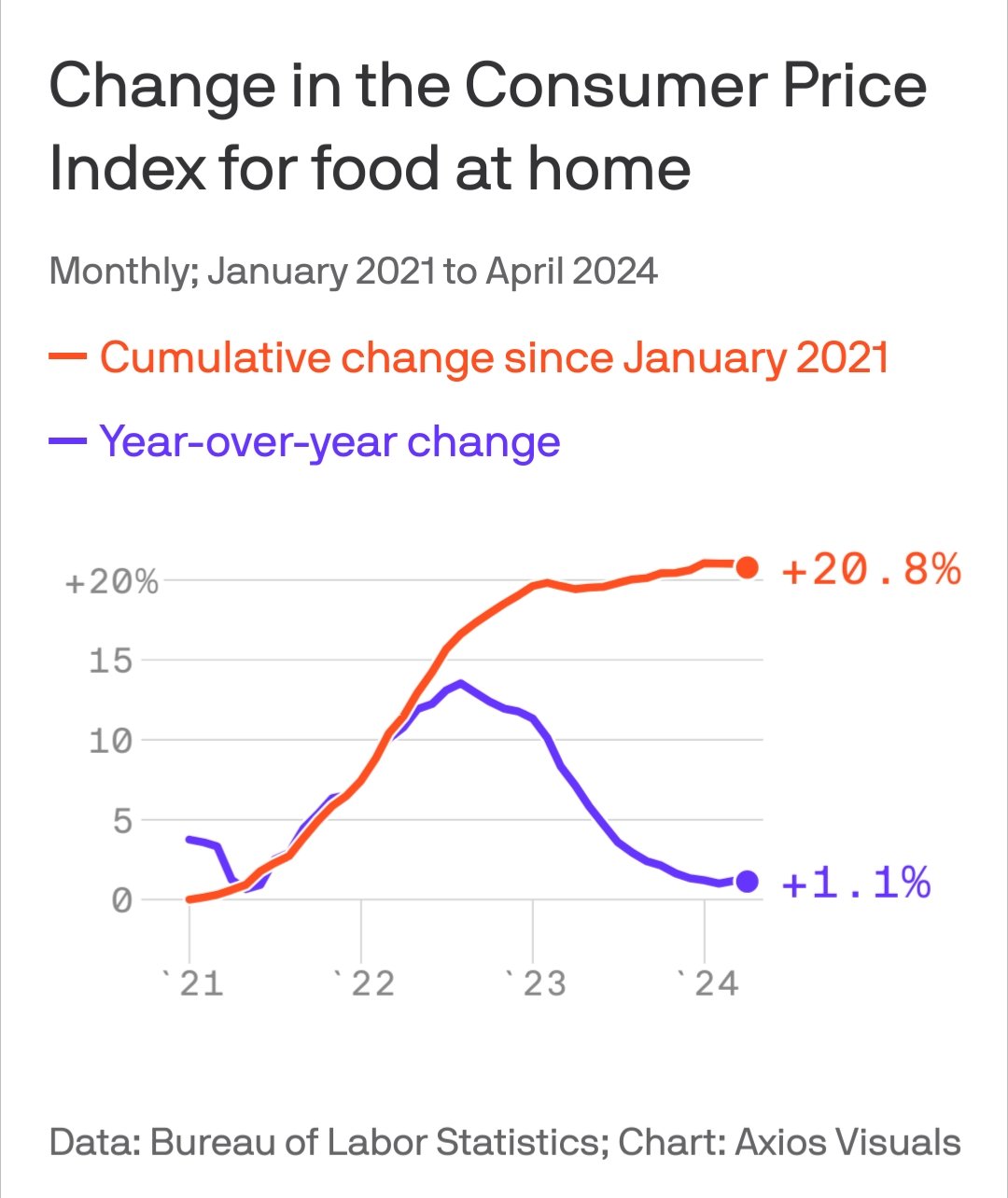

“if you measure in a temporally small enough frame, inflation doesnt exist!”

doesnt stop my can of sparkling water from doubling in price in the last few years just because you want to limit “inflation” changes to ‘12 months’

I very much like how you phrased this.:-)

The problem was never standard inflation.

The pandemic caused the food industry to run into supply chain constraints that legitimately increased prices at a rate higher than standard inflation. Greed set in and they turned those high prices into margin once the supply chains stabilized.

That is the most accurate and succinct explanation I think I’ve seen anyone offer.

But isn’t that just explaining the reason behind the inflation? Prices went up, at that time merely called a “spike”, due to supply chain constraints. Followed by not merely statically keeping those prices but increasing them further still, aka greedflation. But together they fulfill the standard definition:

In economics, inflation is a general increase in the prices of goods and services in an economy.

So I would not agree with the word “never”, and therefore am not sure what you are trying to say.

That’s true. It’s still inflation by definition. Typically when people refer to economic inflation, it’s the expected increase in the cost of goods and services year over year. The standard inflation rate in the US is typically between two and three percent. Referring to this as inflation can imply to some that it’s tied to the standard increase. I’ll edit to include the word standard for clarity.

so stop buying it.

Derivatives always were measured over infinitely small intervals. Basic calculus. And inflation always was the derivative of prices.

Prices are prices. If you want to complain about prices, then complain about prices. But we all know we aren’t going to do anything about prices. Furthermore: falling prices are utterly terrible for economies, so no one wants to force deflation.

Inflation followed by disinflation (ie: holding prices steady after a runup) is our best chance of keeping the economy moving forward. Seriously. Literally no one is asking for lower prices. Its too dangerous.

The prices of commodities fall all the time. What you’re saying about prices does hold true for eg durable goods, but food prices have always fluctuated up and down more than other goods. I’ll be perfectly fine with lower prices at the grocery

Replace each instance of the word “economy” with “rich people’s yachts” and this comment makes a LOT more sense.

I have a fuckton of Democrats and Liberals crying about the unemployment rate. Do you want me to start posting them or do you actually have a memory that lasts longer than 1 year?

yachts

Its not yachts. We’re talking about people’s jobs and livlihoods here. Its a terrible price to pay if we get this wrong, so in many cases people err on the side of inflation.

Its better to get inflation (which is annoying but something we all can ultimately survive) than to have deflation + job losses.

(fast comment male voice) This proceeding comment was paid message brought to you by Goldman Sachs.

(Women’s voice read slowly) Goldman Sachs, because fuck Detroit and fuck your pension.

Furthermore: falling prices are utterly terrible for economies, so no one wants to force deflation.

Oh wow, I didn’t know that more efficient production methods were terrible for the economy. TIL.

They need to add that prices falling is terrible for how we measure economic success

Recipe For Economics: Strip out all the fun interesting parts of Astrology, add a suffocating amount of clueless bros, and dump a full bottle of “rationalizations for not caring about the consequences of our cruelty” on top.

I’m not talking about GDP.

I’m talking about fucking Deflation. The gremlin that caused the Great Depression so no one wants to fuck with Deflation anymore.

The fuck are you in about randomly bringing up GDP when I’m talking about a completely different subject? Are you on some kind of derailment kick right now?

Deflation didnt cause the great depression.

The stock market crash of 1929 where there was too much imaginary money floating around and it sudde ly vanished, combined with several years of freak weather(either too little or too much rain.)

Deflation didnt cause the great depression.

Sure buddy. Its not like people had statistics in the 1929. Oh wait…

The deflationary period began in 1927. Long, long before Black Friday. Deflation then grew out-of-control over the next few years, leading to 30%+ unemployment numbers (because as we all know, deflation causes unemployment).

After the 1930s, this country pretty much swore off deflation ever again. We have done our best to avoid deflation, for good reasons as the graph above should make obvious.

@Punnyname got it right, just say “rich people’s yachts” whenever you see the word “economy” and everything you read makes sense.

If you are a human it’s called rich lizzard yacht money, to the lizzzard people it’s called economics.

Oh wow, I didn’t know that more efficient production methods were terrible for the economy. TIL.

Here’s an example. Lots of people say they would like to own a Battery Elective Vehicle (BEV). One of the most common reason not to is “the price is too high”. There is a segment of people that can afford the higher price but are waiting for prices to fall with the assumed more efficient production methods in place in the future. So these buyers are NOT spending yet. While that may be a good personal finance choice, that lack of spending is bad for the economy as there is less money for auto dealerships, auto transporters, factory workers, parts suppliers, raw materials producers.

If there was no assumption of future falling prices (deflation) those buyers would have already bought a BEV (as they were during the pandemic when prices weren’t likely to fall).

Yeah, but we’re talking about groceries. No one says “I’m gonna fast this week cuz I think groceries will be cheaper next week”

No one says “I’m gonna fast this week cuz I think groceries will be cheaper next week”

They’d say instead “I’ll buy the cheap coffee instead of the good stuff and get the store brand blend of olive oil instead of the EVOO I usually like instead to hold me over until the prices fall next week. I’ll also hold off on getting steaks this week and instead get some cheap chicken thighs”.

No.

People say I’m going to fire all of these meatpackers because COVID-19 closed down the Hotel all this meat is going to and bam, -30% + deflation starts to kick in and our politicians start to panick, because those politicians are smarter than you and know where that was going.

Politicians overcorrected and caused inflation from overaddressing our COVID-19 issue. But I’d rather live with inflation than the massive job loss numbers that was facing us in 2020.

Now today, we have a bunch of dumbasses who can’t even remember the economic calamity we avoided just 4 years ago complaining about inflation that happened fucking years ago.

https://www.vox.com/2020/5/4/21243636/meat-packing-plant-supply-chain-animals-killed

This shit just happened and people are like “Why the fuck did meat prices go up?”. How short-term are yall’s memory? And then we used economics to print a fuck-ton more money to encourage more people to eat meat (to minimize the boom/bust… borrowing from the future so that we’d eat more meat during the COVID19 era), and people wonder where the hell all this inflation came from.

Its pretty fucking straightforward yo. We saved the jobs, we tried to mitigate the culling of hogs / cows. Then we had a boom/bust period that ultimately concluded with 2022-era inflation, and then we tried to deal with that. COVID19 was a very difficult time for policymakers, economics. But we lived through it, but still are dealing with the “ripples” of that change.

Was it perfect? Hell no. Now that we know today’s statistics, we can say that we printed too much money and left interest% rates too low. But overall, we did the right thing, and it’d require a crystal ball showing 2024 data to know whether we printed too much (or too little) money back in 2020. I’m happy we chose to err on the side of inflation and save as many jobs as possible, and if we had a time-machine I’d go back to 2020 and overall support the same actions (though maybe a bit less money-printing so that we don’t have quite as much inflation).

And here I am buying food every week like a fool. I should just not eat until the prices go down.

US government vets said to be ready to assist with culls, or ‘depopulation’ of pigs, chickens and cattle because of coronavirus meat plant closures

You’re a dumbass. Americans stopped eating on a mass-scale due to COVID19, leading to a historical culling of pigs and cows, leading to a boom/bust of our food supply culminating in today’s inflation.

I support the politicians (and yes, bankers) who did hard work to counteract this problem (especially as they acted swiftly, and across party lines). And I shit on people like you who wish to just shit on the hard work of our leaders on this subject. Especially because you’re clearly too stupid to figure out basic history on this subject.

What we did years ago is something to be proud of. But it has a cost, the calculations weren’t perfect and we’re dealing with more inflation than expected in the year 2022. And as the graph at the beginning of the topic points out, the inflation was almost entirely during 2022, and has been hampered by now.

Deflation always leads to job loss.

The US policy is biased towards saving jobs, not really towards being the cheapest stuff. And IMO, I agree with this. In many senses, job preservation is far more important.

https://www.bls.gov/charts/employment-situation/civilian-labor-force-participation-rate.htm

Inflation leads to it as well. Almost as if A doesn’t lead to B.

Dude, COVID19 dropped prices across the board. How cheap were Hotels? Meat? Do you remember the $2 gas prices?

That grey line? That was deflation happening for one month and then every politician in the country stepping on the “inflation button” at the same time. It didn’t matter if you were Republican or Democrat, literally everyone got together in a couple of days and said “Yeah, lets print $1.5 Trillion bucks”.

THIS is what caused the inflation. M2 (aka: the amount of money in the USA).

And every politician hit the “Make more M2 / Make more money button” because holy shit COVID19 is fucking our economy, we’re about to fall into deflationary spiral somebody please save us mode.

Job losses caused inflation, because politicians got together and did something about it. And they did it so quickly that most people seem to have forgotten it despite it only being 4 years ago and you’re fucking up the order of history. COVID19 shut things down, and then came the inflationary stimulus / law changes

Those poor rich people’s yachts

You know damn well that its the Liberals crying about jobs that prevented us from raising rates and better addressing inflation.

i know, right! thats exactly what all the single moms in the poor neighborhood around the corner were sayin

Soccer moms say ‘I want to keep my job’.

Which is interpreted to be ‘We must avoid deflation’ by the Fed. Because these two statements are one and the same.

Between the choice of widespread unemployment vs fixing inflation, the policymakers came up with the current strategy. Lower inflation (aka: first derivative of price chances), which should hold jobs steadier than other options.

The Fed has a very blunt instrument for economic policy. It’s either lose jobs but fix inflation (aka higher rates), or more jobs but inflation gets out of hand (aka lower rates).

That’s just how the world works. Those are the only two choices the Fed has.

The only 2 options hahaha. Kk.

Do you not know how the Federal Funds Rate works?

Lovely.

There’s two directions. You can raise rates, or you can lower them. Raising rates causes job losses but culls back inflation. Lowering rates increases the number of jobs but causes inflation to go up.

Its a fucking number… Because its a number, there’s only two directions to go. Up or down. Or zero if you want to split into a 3rd option for some reason. But not much aside from “raise”, “hold” or “lower” rates.

Now comes the political debate. Should we have been raising rates last year? Or should we have been lowering rates last year? And survey says… Oh right, liberals were asking to lower rates (ie: making inflation worse). Ding ding ding!! It pays to be a dumbass, because its the only way you can keep your petty little brain straight, isn’t it? You don’t like facing reality of your side’s opinions, do you?

Its not just conservative dumbasses who are unable to foresee basic problems with their politics, but also far left liberals who demonstrate ignorance. Thank you for making an example of yourself.

You sound like an economist

As opposed to you? Who has come into the topic to talk about CPI and Inflation while proudly displaying ignorance to simple monetary matters?

If you want to talk about health, you bring in doctors or other health specialists. If you want to talk about the economy and how to best build a country and a system of money, you need to bring in bankers and economists.

If you don’t care about money, then leave the topic. Don’t shit on people while being ignorant, at least take a step forward and learn the basics.

Heard it right here folks. Don’t think, don’t observe, don’t comment. Have blind faith in the economists, economists who continue and consistently lie to us about the situation because their banker friends are paying them to do it.

Not a science with zero predictive power.

Now off you go, write some article about how awesome student loans are and how universal healthcare is a a bad idea. Fortune or the Economist both will publish it.

You sound like a COVID19 denialist. Except instead of denying basic health science, you’re denying basic economics. I’m not sure if you really want that look for yourself.

But yeah, who cares about Fauci or whatever health care specialists think. They’re all paid off by the liberals. No wait, I’m on a liberal forum now. I’m supposed to hate bankers and economists now and deny basic economics. Yeah…

Who cares about Powell or basic economic predictive factors like M2, montetary policy, CPI or inflation. Those guys don’t know anything anyway, despite saving our jobs and preventing one of the worst economic disasters of our country in the last hundred years. They’re all dumbass rich elites from the coast. (No wait, that’s a conservative talking point, right?). Erm… they’re all rich bankers. Right, rich people. Not elites, its conservatives who hate elities, its liberals who hate rich people.

But in all cases, proudly displaying ignorance is the best move. Amirite?

You sound like a COVID19 denialist.

Come up with better insults banker. I been called much by much better.

Except instead of denying basic health science, you’re denying basic economics. I’m not sure if you really want that look for yourself.

Except instead of denying basic health science, you’re denying basic RICH PERSON’S YATCHTS. I’m not sure if you really want that look for yourself.

Ftfy

But yeah, who cares about Fauci or whatever health care specialists think. They’re all paid off by the liberals. No wait, I’m on a liberal forum now. I’

Now now let’s not compared medicine to your playtime rules.

Supposed to hate bankers and economists now and deny basic economics.

Supposed to hate bankers and economists now and deny basic RICH PERSON’S YATCHTS.

God that works so well.

But in all cases, proudly displaying ignorance is the best move. Amirite?

Well it is certainly working for your boys CATO and Heritage.

https://www.youtube.com/watch?v=RcFGzz839ZU

Cry more to AOC, who was part of this inflation problem crying about jobs and holding back Powell from raising the FFR to combat inflation.

Oh right, you’re a dumbass who don’t realize you’re shitting on your own side right now. AOC cried about everyone’s jobsss and unemployment that’s completely fucking non-existent right now. We undershot the employment rate, its clear we had to go higher and steeper with these interest rate hikes.

And you’re here sitting like an idiot, unable to comprehend basic history, fucking up your side of the discussion.

But sure, pretend that I’m the one who is a problem despite taking my time to talk about what’s going on. You’re welcome by the way, now please, sit down and think about your discussion points and where the politics have been laid out over the past couple of years.

Powell here was right and honestly… Powell was on the side that protected jobs too much. We all had to go higher on the FFR and push % even higher given what we know about the situation today.

We’re all asking for lower prices fuckstick

Liberals are asking for all kinds of inflationary pressures. Student loan forgiveness, higher minimum wages, job protections. And most dramatically, AOC asking for lower rates when talking to Powell last year.

It’s actually rather difficult for me to think of a singular Democrat policy that’d have deflationary effects… Well… There’s always raising taxes which I’d strongly support. Especially right now when inflation is at the forefront of a lot of people’s minds. It’d cause a slowdown in spending and likely drop prices.

pretty much.

i’m sure some people deserve student loan forgiveness. but most people i know who got it didn’t. they were purposing not paying back their loan so they could spend money elsewhere on luxuries.

and interest rates shoudl stay high. lowering them again to 1% will further fuck the economy for the working class like it has been for the past 20+ years of low rates. poor people don’t borrow much money, rich people do. Hence why wall st is the one pushing super hard to lower rates again.

Your math is poor a.f. And your argumentation doesn’t hold. The inflation rate is the relative change over a defined time-period. It is not a derivate. And a 10% interest rate p.a. corresponds to a .026 % interest rate per day. But that is still not the derivate. So @originalucifer@moist.catsweat.com is absolutely right also for interest rates.

The inflation rate is the relative change over a defined time-period. It is not a derivate.

Have you taken Calculus? This is one of the most basic of Calculus subjects. https://en.wikipedia.org/wiki/Time_derivative

Time derivatives are a key concept in physics. For example, for a changing position x its time derivative dx/dt is its velocity, and its second derivative with respect to time, d2x/dt2 is its acceleration. Even higher derivatives are sometimes also used: the third derivative of position with respect to time is known as the jerk. See motion graphs and derivatives.

I know not everyone takes Calculus. But this is quite elementary if you’ve taken the subject. There should be no confusion here.

Inflation is the change of price over the change of time. Or alternatively, Inflation describes the first derivative of price. What people care about however is the overall price, which unfortunately policy-makers can’t really control that well. We only have controls over the change-of-prices (ie: the derivative), not the actual direct price controls.

EDIT: My note about “infinitely small intervals” is the basic limit definition of the Derivative. https://tutorial.math.lamar.edu/classes/calci/defnofderivative.aspx

The interest rate is commonly given p.a. so per year. So if you take a shorter time it becomes arbitrarily small. But to take acceleration as an example. If you have an acceleration of 1 m/s² it is a derivate. But if you take it as the acceleration over a year you get 31,536,000 m/year² which is also technically a derivate, but a completely nonsensical expression.

And that was the joke @originalucifer@moist.catsweat.com made. And you showed why mathematicians don’t like it if economists want to brag about their math knowledge. Because you think your basic calculus qualifies you to be overly pedantic without showing real understanding of the concepts behind it.

doesnt stop my can of sparkling water from doubling in price in the last few years just because you want to limit “inflation” changes to ‘12 months’

You’re going the wrong direction yo to his original words. I don’t even know what you’re complaining about anymore. The original poster was trying to stretch time out to multiple years. My joke was that shorter-time frames is what is more accurate because that’s what mathematics / calculus has traditionally done.

I’ve said my piece, and I stand by it. I’ll repeat it here.

Prices are prices. If you want to complain about prices, then complain about prices. But we all know we aren’t going to do anything about prices. Furthermore: falling prices are utterly terrible for economies, so no one wants to force deflation.

I’ve done many inflation topics over the last 5 years. I’m surprised at how utterly shit people around here on this topic are. I’d expected more of lemmy users to know the basics of this subject. But I do appreciate you trying to catch me on a technicality, however arbitrary it was… you’ve demonstrated that you’re at least at the Calculus level to me.

Are you kidding?

Quick thing is that inflation is not a problem when wages catch up. During the pandemic, prices went up but wages stagnated. Now wages are keeping up with inflation but are consistently running behind the still increasing cost of other stuff. That gap is what’s making life difficult for people.

This is really true when you think about how much wages have fallen behind for years. To make up that much ground there needs to massive raises. Like the ones won by UAW recently. It will take time until that happens

Remember $15/hr minimum wage? If it had kept up with inflation, minimum wage would need to be $25/hr now.

Plus for context, that would be the national federal minimum wage, meaning the floor in the poorest of states. Some states would have a higher minimum just like they do now, but higher than the national wage.

Exactly. We need a much higher minimum raise

Real wages are up for the past six years.

I know. It’s the first time in a long time.

Since like ‘75 or so. It’s been a minute.

Except if you’re retired. Your bills go up and your income/savings doesn’t.

Sure, if it isn’t invested.

I wish my wages were keeping up like yours

We’re not talking about one person, but the macro-economic trends in general. Many individuals will not follow the trend, as it represents the economy as a whole.

That is correct! Thanks for responding for me so succinctly.

The best way to make more money is to get a new job. Employers take advantage of the fact that getting a new job takes work and can be uncomfortable, and a lot of workers avoid having to deal with this and accept a stagnant wage. At my previous employer, I was hiring new staff again $10K-$15K/yr more than staff that had Been there 5 years. My advice to every new grad was to work there for 2 years for the experience then find something else. If you liked it enough to come back, after having 3 total years of experience you could easily get $10K more than you made before

deleted by creator

It isnt fucking feelings my grocery bills are higher for the same amount of food compared to a year ago.

Of course. Inflation being lower does not mean the prices get lower. It just means rate that price rises will slow. They will still rise but more slowly. Think of it like acceleration. It is like the difference between how it feels to go from 25 mph to 50 mph over a mile compared with going from 50 mph to 55 mph over a mile. You are still accelerating but you don’t notice the difference as much. Prices overall are similar but hitting the brakes and going down in prices hurts a hell of a lot more than simply slowing how much prices rise.

Yes, but in this case, they should. The food industry ran into supply chain constraints which legitimately increased prices at a rate higher than inflation. The greed is present now that they’ve stabilized the supply chain and continue to charge the same prices, padding their margin.

Yes and no. They did have some supply chain issues but those subsided quite a while ago yet they kept the rate of price increases up padding their margins because people expected inflation (aka price gouging). Right now though food prices are rising below the rate of general inflation. That said, I could certainly see prices dropping a bit since they did rise way above inflation for a while. That likely made the industry much more attractive to enter which likely means people having to sell off their shit after price increases returned to normal.

That would require fair market representation in grocery stores. Most of the time, small brands don’t last long in the market before being bought out by one of the big 12.

20% my ass, CPI is so laughably understated it should probably be a crime. My grocery bills have doubled during the timeframe depicted on the chart.

the fuck are you buying?

mine have gone up about 30%. and i buy the same shit i did 4 years ago.

some things went way up, then came back down, like eggs.

most of what went up was meat and processed foods. dairy and veggies didn’t see much of a spike. milk is still 5 bucks a gallon.

A 12-pack of soda cost $2.50 5 years ago. It’s now $10. So yeah, some things are just pure unfettered greed.

Have you noticed the volume of the items you have been buying also shrink 20 %?

Because 3.5% on top of 3% on top of 9% is not a decrease.

We essentially had a generations worth of inflation in 3 years.

Significantly less than a generation’s worth. 20% inflation is closer to 8 or 9 years worth of inflation. Inflation was a hell of a lot worse in the 70s and 80s. We notice it now because we have been used to <2% inflation for so long.

bingo.

but nobody wants to talk about that. inflation being super low also is why the housing market exploded… because borrowing was incredibly cheap and asset prices rose far faster than labor prices. assets were super cheap in the 70s/80s and started exploding in the 90s when we started starting pushing interest rates to historic lows.

I’d be interested in seeing a price comparison of some specific items over the course of the last four years.

I’m well aware of the reporting and personal stories people have shared about rising inflation. Inflation is real. Price gouging is real. Climate change, environmental factors, livestock disease are real. I am not at all questioning that. However, I am curious as to how these factors have had little impact on my personal shopping experiences.

I live in a major east coast city. I buy 85% of my groceries from a local produce market. I rarely buy packaged foods or prepared items. Most of my groceries are local in-season fruits, veg, protein. I’ve been paying the same $5-$6 for a dozen eggs for nearly ten years. My grocery bill for the week is typically $80.

So, it’s been weird observing, from a distance, the conversation about inflation and how people are struggling to buy groceries.

I’d like to know if and / or how a small grocery store can maintain prices for over half a decade. Is it because the products are limited in their interactions with others - less inflation due to shipping it all over or compensating for rising prices of ingredients (milk, flour, eggs, etc). Is it because the metrics for “bills seem high” is based on grocery items I’m not purchasing. Is it based on geographic location or the store items are acquired? Is it because people are buying more at the store to take home rather than spend money out for dinner (because that certainly has increased). Is buying local actually a life hack for saving money?

I mean, I’m reading the chart and it’s saying prices are up 21% since '21 but I am not personally seeing that. I’m curious as to why that may be. The 22% for ‘food away from home’ though, I can absolutely confirm in my experience.

I’d be interested in seeing a price comparison of some specific items over the course of the last four years.

That’s called the CPI and its what the topic is about. I highly suggest you read the CPI releases. You might learn something. https://www.bls.gov/news.release/cpi.nr0.htm

I mean, I’m reading the chart and it’s saying prices are up 21% since '21 but I am not personally seeing that. I’m curious as to why that may be. The 22% for ‘food away from home’ though, I can absolutely confirm in my experience.

CPI splits Urban vs Rural, and into economic zones like East, West, and… even by State.

https://www.bls.gov/news.release/cpi.t04.htm

If you want some help browsing these statistics, feel free to ping me.

I’m not seeing specific items in that link. I’m thinking, for example, a 3 lb chicken, a pound of 80/20 ground beef, a pound of honey crisp apples, a head of romaine lettuce, etc.

The second link is interesting. I’m in the Philadelphia area which is one of the greater percentage increases. I’d like to know what exactly is being indexed.

deleted by creator

The Walmart app provides historical receipt data if you have an associated card. A few months ago I spot-checked a ‘standard basket of goods’ (food and household items often repurchased) for myself between then and the end of 2019 (right before covid), and the average increase in price of those goods over that period of time was just about 50% overall for my personal basket of goods.

I’d be interested in learning what items increased and by how much over time.Edit: I guess this covers that question https://www.bls.gov/news.release/cpi.t07.htm#cpipress7.f.4

I like this simple graph and article. It shows that inflation has slowed but since it always a positive the total affect is still large.

Should I belive these graphs or the receipts from my grocery shoppings? 🤔

The graphs if you’re talking about the economy as a whole.

So the part that isn’t based on wages or personal costs and therefore irrelevant for the average person outside of being a reminder that a worker’s increased productivity has not been rewarded with a matching increase in pay.

The graphs are macroeconomics, your receipts are microeconomics. Two different worlds that people mix up. That’s also the point of the article.

I wouldn’t expect them to be much different.

Now do price per amount.

Every time someone complains about Inflation being to high, I immediately believe the failed 9th grade Math and don’t know what derivatives are.

I can tell you’re not from the US because I didn’t encounter derivatives until 12th grade

Yea, I’m from Germany. I don’t remember exactly, but it was probably like 9th or 10th grade. 12th was graduation. And you gotta learn all the Integral stuff and e functions etc. after derivatives. Do you do all that in one year?

While that’s true, my niece in 7th grade just did her first “Rise over Run” section.

Sure, Calculus / Derivatives is 12th grade math. But the basics of “rise over run” is 7th, or even 6th or 5th grade.