Sus admin alt account. Throwra_scentsitive on Reddit.

- 28 Posts

- 35 Comments

1·11 months ago

1·11 months agoReplace “teller” with “bank” because we are talking about legal ownership, not physical control.

They don’t have anything but a responsibility to care for it

While they absolutely “have a responsibility” to you, they also benefit from holding it, so your “anything but” rhetoric is incorrect. Brokers and banks alike earn money by lending the assets the have, despite their corresponding liabilities.

Do you think there isn’t a “clear record” without direct registration (from your other comment)

Correct. Legally, you have a “security entitlement”. Per UCC 8-503, the property interest you have a result of this entitlement is merely “a pro rata property interest in all interests in that financial asset held by the securities intermediary”, i.e. what your broker actually has, which is (a) opaque to you as a customer, and (b) is fundamentally difficult even for them to pin down - as it is composed primarily of their DTC account balance, ideally but they undoubtedly have many derivatives, transactions to settle (which can extend beyond 2 days because FTDs are common), shares lent out that are due to them, etc. So while the number of security entitlements in your account has a clear record, your property interest in the issuer does not have a clear record.

2·11 months ago

2·11 months agoReuploaded to OP!

2·11 months ago

2·11 months ago@Chives@lemmy.whynotdrs.org doesn’t user tagging work?

4·1 year ago

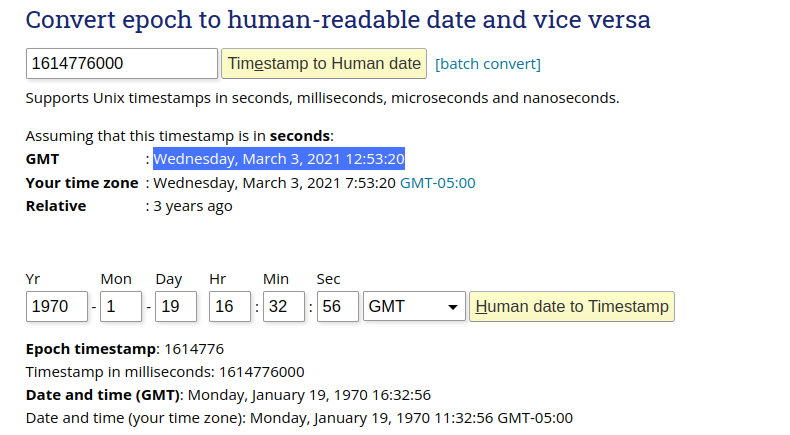

4·1 year agoThe “event timestamp” is most likely stored in epoch seconds but being interpreted as epoch milliseconds. If you correct that, it works out to March 3rd, 2021.

Edit to add: Regardless, I am calling this a nothingburger, I’d be willing to bet that the 999… value is just a placeholder for unknown values.

5·1 year ago

5·1 year agoMaybe if you have a fever, and the only prescription is more DRS

(sorry, couldn’t resist)

7·1 year ago

7·1 year agoI’ve been going with Liquidate Wall Street personally

3·1 year ago

3·1 year agoIt’s the older one that was made for actual collaboration on the drsgme.org website.

I’ve re-uploaded it to my Google drive: https://drive.google.com/file/d/1gqT4UdIoURT_LFZko3tpnfqzNc7pffcc/view?usp=sharing

2·1 year ago

2·1 year agoAre you in this discord? If not, I can find another place too upload it…

https://discord.com/channels/955819881989808128/1059573570122023022/1060301849695105036

181·1 year ago

181·1 year agoDisclaimer: I have not watched “This is Financial Advice”, so if I miss something that’s covered there, my bad. Maybe I’ll have time to watch it someday, but that day is not today.

Your skepticism is understandable. However, my expectations around future GME (the security) prices are not fundamentally about expectations around GameStop (the company). All GameStop needs to do is not go bankrupt (which they are doing quite well based on their cash on hand), and any future business success / profitability is just icing on the cake.

Rather than betting on some unimaginably successful 1,000x business transformation, I am betting against Wall Street. Fundamentally, valuation of securities works on the assumption that shares are fixed in quantity (or only created/destroyed by equity-preserving events by the issuer). With the ubiquitous rise of online brokerages, security entitlements, high speed trading, and a derivatives market that far eclipses the value of the underlying assets, that assumption is flawed and regularly abused by Wall Street to extract huge sums of wealth from investors and issuers. At the same time, Wall Street is laxly regulated and hugely greedy, and has no qualms about putting itself in risky situations for short term profit with the assumption that problems will be fixed down the road. Unfortunately for them, that situation has been threatened since the events of January 2021. Since then, all the evidence I’ve seen suggests that the financial institutions, many of them mutually liable for each others failures under the DTC or other organizations and settlement agreements, are regularly engaged in kicking the can down the road and perpetuating net short positions. However, since 2021 investors in GME have started removing their shares from Wall Street, meaning that eventually accountability will be required for naked short positions and then true price discovery can occur. Until then, price fluctuations only matter to help me understand how many more shares I can acquire.

5·1 year ago

5·1 year agoYup. I have a recording from the WSB daily space/call from the morning after where they coyly allude to it while also denying it

6·1 year ago

6·1 year agoPreposterous…

“We appreciate Pulte likes the stock, but so do so many other wonderful stockholders.” … and Pulte content is removed, so any stockholder content is off limits by that logic.

PS. I would’ve missed this if not for your post, thank you for capturing and sharing!!!

2·1 year ago

2·1 year agoAh, my home state!

5·1 year ago

5·1 year agoIf at a broker, keep lots smaller than 100

I’m not convinced that selling multiple shares is better than selling a single share for multiple times as much. My hope/goal is to keep 99.9% of my shares through MOASS. And 100% of my DRS’d shares.

4·1 year ago

4·1 year agoI’ve fixed it again, thus solving the problem once and for all

All previously uploaded images are still available on a storage bucket (but with a corrupted index file), so if anyone wants to try to reconstruct things at their own peril, they can reach out to me for access…

5·1 year ago

5·1 year agoThe whole NFT thing was dead on arrival

I think that’s a bit premature.

While I’m sad that they shut down all the shareholder requests for an NFT dividend (for now), I still think the need filled by NFTs in gaming is undeniable in the long term, so I’m not ready to call the NFT marketplace dead yet. I imagine it would be pretty awesome if you were browsing in your local physical GS and could see and buy in-game assets right there in-store!

1·1 year ago

1·1 year agoWho knows, I’m not sure if it would even get on his radar

1·1 year ago

1·1 year agoHey :) Instance admin here…

In contrast with some of the moderation patterns we sought to escape on Reddit, instance admins are limited in what we are going to moderate, as covered in our pinned post: https://lemmy.whynotdrs.org/post/1209 (under the “Moderation Policy” heading)

On the other hand, community (“sub”) moderators may implement more restrictive moderation policies/practices, however the moderator for this community is the person you are raising concerns about, so they likely won’t be moderating themselves… though you never know, they may be open to listening to community feedback and implementing a more democratic approach to community moderation.

I think the best option would be creating a competing macro-economy community with moderation policies/practices that are more appealing, and trusting users to select the community that works best for them.

5·1 year ago

5·1 year agoWhoa, this one is pretty unique with both of the numbers worked in there! Super cool :)

Hey! I’ll admit I’ve slept a bit on the status of DRS estimates between the quarterly report numbers… thank your for taking up the mantle of providing this data!